For small business owners, finding the right loan can be a game-changer. Whether you need funds to expand, buy equipment or manage cash flow, a business loan can provide the financial boost you need. But with so many options available, it’s not always easy to figure out which loan is best for your business. This is where a business loan comparison tool like Menna can make the process simpler and faster.

Here’s how Menna can help you make the best financing decision for your business.

What is a Business Loan Comparison Tool?

A business loan comparison tool is a digital service that lets you compare different loan options side-by-side, so you can easily see details like interest rates, repayment terms and eligibility requirements. It saves you time by gathering loan offers from multiple lenders in one place, making it easier to find a loan that fits your needs and budget.

Why Use a Loan Comparison Tool?

Finding the right loan without a comparison tool can mean visiting multiple lender websites, reading through terms and filling out multiple applications—each of which can be time-consuming and overwhelming. Loan comparison simplifies this process by bringing all the information to one place.

Using a loan comparison tool helps you:

- Save Time: Instantly compare loan options without having to go from bank to bank.

- Find the Best Rates: See interest rates across different lenders to find the most affordable option.

- Understand Loan Terms: Compare repayment terms and other conditions side-by-side to pick a loan that works for you.

- Make an Informed Decision: With all the details at your fingertips, you’re more likely to find a loan that meets your needs.

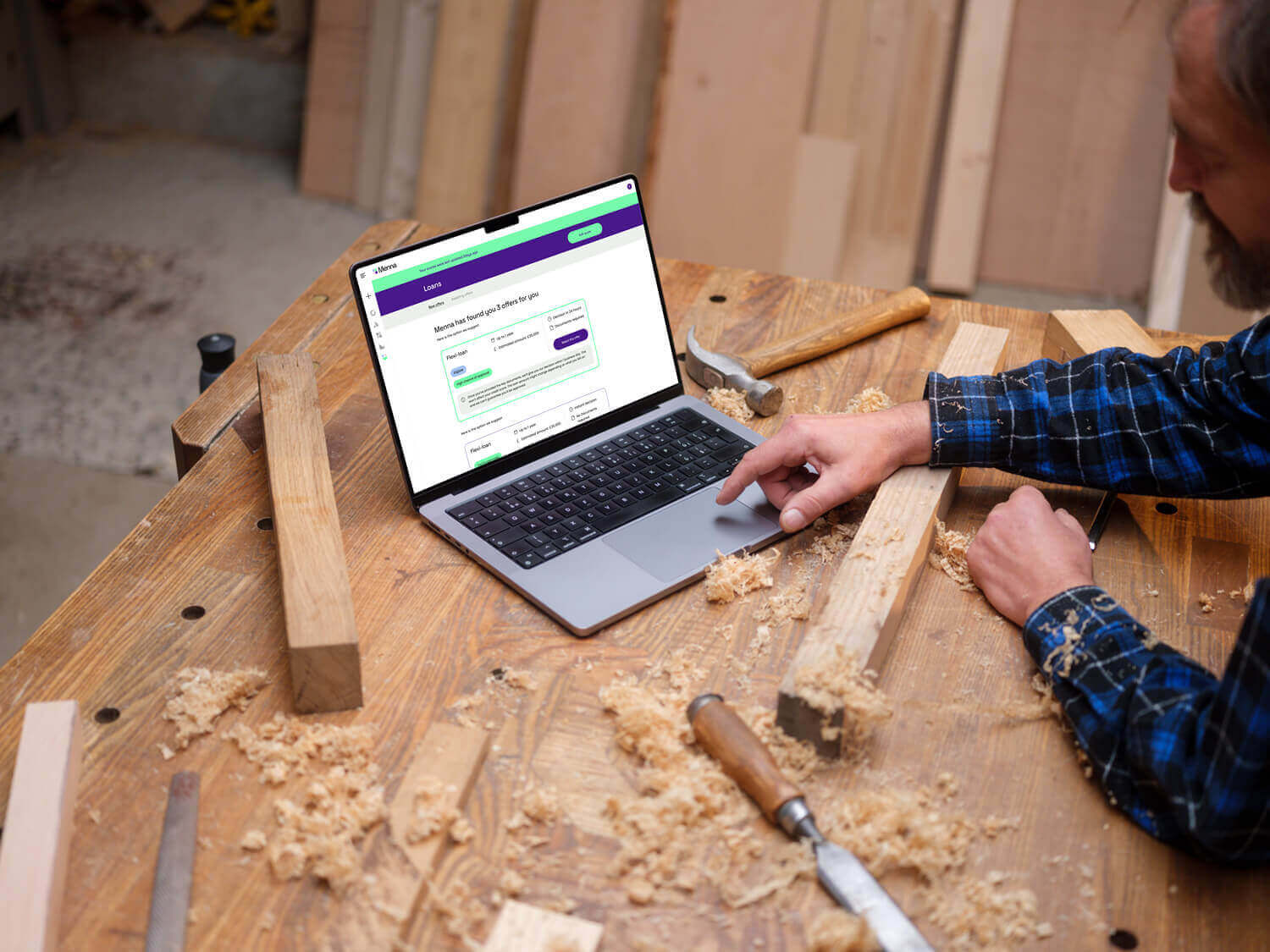

How Menna’s Business Loan Comparison Tool Works

Menna is designed to make it easy for small business owners to find and compare loans quickly. Here’s how it works:

- Menna Chat

- Start by chatting with Menna, where you’ll answer a few quick questions about your business, such as how much you’re looking to borrow, your preferred repayment period and the purpose of the loan. Menna Chat gathers the essential information needed to find the best loan options for you.

- Get Personalised Loan Options

- Menna uses your details to generate a list of loan options that match your requirements, showing offers from multiple lenders with terms tailored to small businesses.

- Compare Key Loan Details

- Review important details like interest rates, repayment terms, eligibility requirements and any fees. Menna’s tool makes it easy to compare each option side-by-side.

- Select the Best Fit for Your Business

- Once you’ve compared your options, you can choose the loan that best suits your business needs. Menna provides a straightforward application process, guiding you on how to apply directly through the chosen lender.

Benefits of Using Menna’s Loan Comparison Tool

- Quick Access to Multiple Lenders

- Menna’s tool connects you with a wide range of trusted lenders, giving you access to loan offers you might not find on your own.

- Transparent Information

- Menna provides clear, transparent information for each loan option, so you can make decisions with confidence and avoid hidden fees or confusing terms.

- Saves Money

- By comparing loans in one place, you can easily find the loan with the lowest interest rate and best terms, potentially saving you thousands over the life of the loan.

- Tailored Recommendations

- Menna’s AI-driven tool offers personalised loan options based on your unique business needs, helping you find a loan that aligns with your goals.

Common Loan Types You Can Compare

Loan comparison covers a variety of loan types to help you to find the right option:

- Term Loans: Fixed loan amounts with regular repayments over a set period.

- Lines of Credit: Flexible funding that allows you to borrow as needed, up to a set limit.

- Equipment Financing: Loans specifically for purchasing equipment, with the equipment serving as collateral.

- Invoice Financing: Short-term funding based on outstanding invoices, giving you quick cash flow access.

Why Menna’s Loan Comparison Tool is Right for Small Businesses

Menna is committed to supporting small businesses with affordable, accessible financial tools. Our loan platform is designed with small businesses in mind and offers a user-friendly interface and personalised loan options. This empowers you to make smart financial decisions, giving you the tools to grow your business with confidence.

Ready to Find the Right Loan for Your Business?

Getting the right loan can make a significant impact on your business’s growth. Menna koan comparison simplifies the process, giving you a clear view of your options so you can choose the best loan for your needs. Try Menna today and take the guesswork out of finding the right financing for your small business.

Take Control of Your Finances Today

Sign up for Menna to stay on top of your finances and access the credit you need to grow.

Frequently Asked Questions

What is a Business Loan Comparison Tool?

A Business Loan Comparison Tool is a digital tool that allows you to compare various loan options from different lenders side-by-side. It provides details like interest rates, repayment terms, and eligibility requirements, helping you find a loan that fits your business needs.

How does Menna’s Business Loan Comparison Tool work?

Menna’s tool starts by asking you a few questions about your business and loan needs through Menna Chat. Based on your answers, it generates personalised loan options from multiple lenders, allowing you to compare terms and rates in one place.

What are the benefits of using a loan comparison tool?

A loan comparison tool saves time, simplifies the search process, and helps you find the best interest rates and terms, making it easier to choose a loan that’s affordable and meets your business needs.

Is Menna’s Business Loan Comparison Tool free to use?

Yes, Menna’s loan comparison tool is free to use. You can explore multiple loan options and compare details without any cost or commitment.

Does Menna provide loan recommendations based on my specific business needs?

Yes, Menna’s AI-driven tool offers tailored recommendations by analysing your business information and loan requirements, helping you find the most suitable financing options.