Menna makes it easier to find the right small business loan. Understand how lenders view you, improve your chance of acceptance and find finance with confidence from our panel of lenders.

What are Small Business Loans?

Small business loans vary greatly depending on how much you want to borrow, for how long and what you’re planning to do with it. Lenders typically offer either a set amount or a flexible line of credit you can draw on as you need. You repay the amount borrowed over time, plus interest.

What Types of Small Business Loans are Available?

There is a wide range of loan options to choose from depending on your needs and financial position. And each comes with its own set of risks, so it’s important to find the right one.

Term Loan

A lump sum loan repaid over a set period with interest; ideal for one-time purchases or expansion. Long-term commitment; can strain cash flow if revenue is inconsistent.

Secured Loan

Term loan backed by business assets like property or equipment, often with lower interest rates. Good for larger, longer-term investments. Asset repossession if repayments aren’t met.

Unsecured Loan

Term loan based on creditworthiness, without collateral, but usually with higher interest rates. Suitable for smaller or shorter-term needs. Higher rates and stricter credit requirements.

Business Line of Credit

Flexible credit limit for short-term needs; only pay interest on what you borrow. Best for managing cash flow or unexpected expenses. Higher interest if used frequently or left unpaid.

Invoice Financing

Advances on unpaid invoices, improving cash flow while waiting for customer payments. Great for businesses with slow-paying clients. Relies on a strong customer payments pipeline.

Asset Finance

Loan for purchasing or leasing equipment or vehicles, secured against the asset itself. Useful for equipment-intensive industries. Asset repossession if repayments aren’t met.

Merchant Cash Advance

Loan repaid through a percentage of daily card sales, suitable for businesses with card transactions. Best for retail or hospitality. Higher fees and variable daily repayments.

Startup Loan

Government-backed loan for new businesses, with fixed rates and repayment terms. Suitable for launching or growing a new venture. Strict credit requirements and limited loan amounts.

How Much Can I Borrow?

Menna’s lending partners offer small business loans from £1,000 to £500,000. The amount you can borrow depends on your business, your financial situation and the type of loan you want.

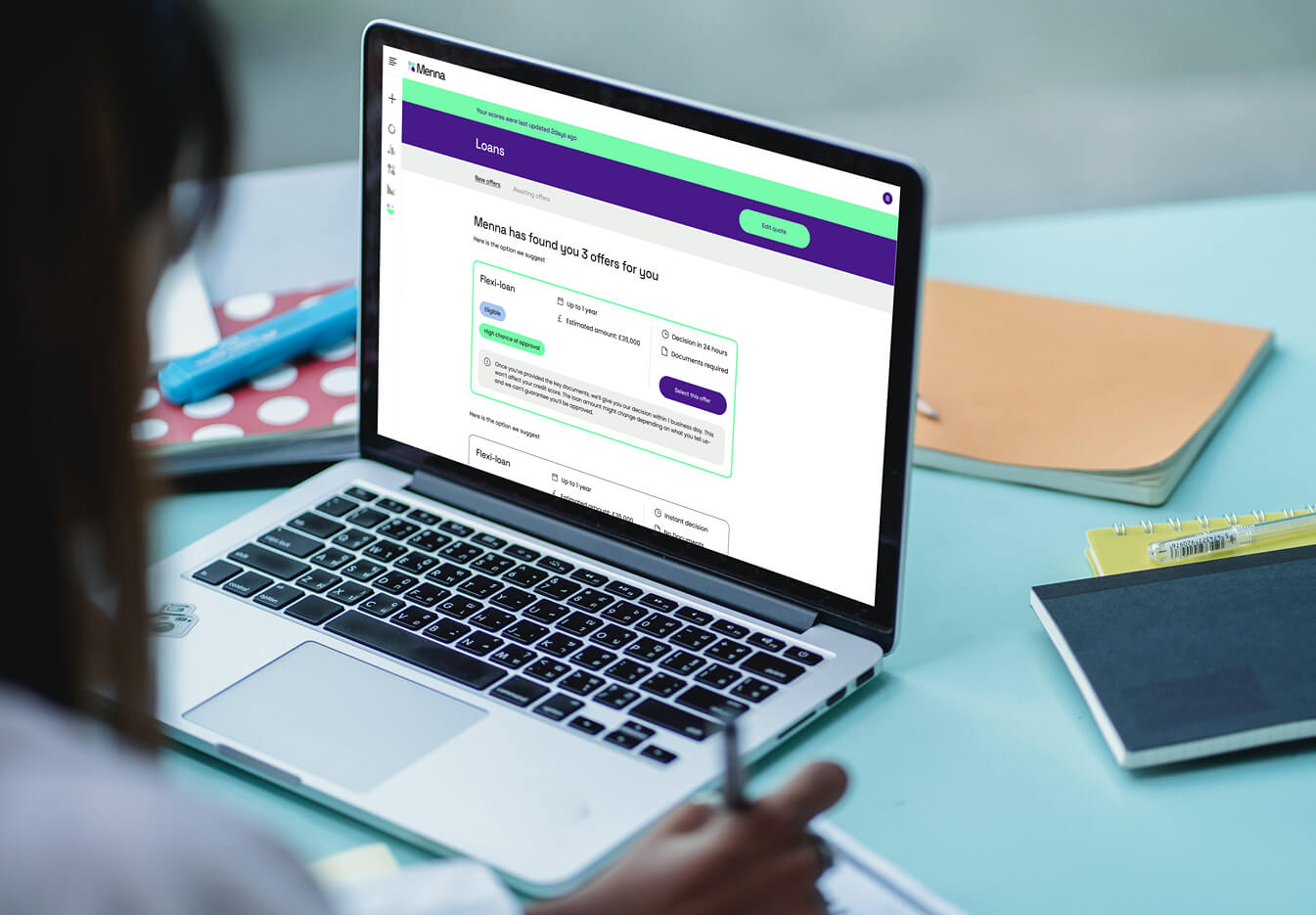

Menna Helps You Find the Right Business Loan

Menna uses AI and insights based on your credit score and affordability, so you see only the loans that meet your needs. We give you a personalised list of lenders from our trusted panel, helping you feel confident and ready for what’s next. Whether you’re starting up, expanding, or covering cash flow, we’re here to guide you through the whole process.

Menna Supports You Every Step of the Way

Prepare With Confidence

Before you apply, understand your credit and affordability so you know what to expect.

Personalised Insights

Whether you have questions, need reminders or just want guidance, Menna assistant is there for you.

Check Loan Eligibility

Menna shows you how lenders see you and how to improve your chance of acceptance.

Menna Customers

We’re here to support small business owners to manage their finances better. From sole traders and startups to established small businesses across a wide range of sectors, Menna helps you secure the funding you need to grow.

How Menna Helps You Find a Business Loan

Comparing business loan rates with Menna is quick and easy.

Log in to your Menna account or create an account in seconds.

Tell Menna how much you want to borrow and what it’s for.

Share your business finance information with Menna or simply connect to Open Banking and we’ll do it for you.

Use the Menna Assistant to compare offers from our panel to find the right loan.

Complete the online application process with your chosen lender.

Frequently Asked Questions

How does Menna help me find a business loan?

Menna connects you with a panel of trusted lenders based on your unique needs, credit score and affordability. We give you personalised insights and show you options that suit your business, helping you navigate the loan process with confidence.

Does Menna lend money directly?

No, Menna is not a lender. We’re a finance assistant that uses AI to help match you with suitable loans from our panel of partner lenders.

What types of loans can I find through Menna?

Menna’s lender panel offers a variety of loan options, including working capital loans, loans for business growth, loans to improve cash flow and equipment financing. We’ll help you find the best match for your specific needs.

How does Menna check my eligibility for a loan?

Menna uses affordability insights and credit scoring to assess your financial position, so you see options that are right for you. This helps improve your chances of finding the right loan without unnecessary applications.

Will checking my options with Menna affect my credit score?

No, exploring loan options with Menna won’t impact your credit score. When you’re ready to apply, we’ll guide you through the process with the lender of your choice.

How can Menna improve my chances of getting approved?

Menna’s affordability and credit insights help you understand where you stand financially before you apply, giving you a better chance of finding suitable loans and submitting stronger applications.

How does Menna keep my information secure?

We take your data security seriously, using strong encryption and secure practices to protect your personal and financial information at every step.

How much does it cost to use Menna?

It is free to apply for a loan on Menna. We make it easy to explore your options and connect with lenders without any upfront costs.

Can I compare multiple loans through Menna?

Yes, Menna’s platform lets you see and compare different loan options, helping you find the one that best suits your business needs.

How do I get started with Menna?

Getting started is easy! Just sign up, enter some basic details about your business and we’ll show you a tailored selection of loan options from our lender panel.

Ready to explore your loan options? Menna is here to help!

Ready to Get Started?

Finding a business loan doesn’t have to be stressful. With Menna, you’re in good hands—sign up today and start exploring options that are right for you.

Latest News and Insights

Company Credit Checks: A Complete Guide for Businesses

5 Reasons Why Small Business Owners Should Run Credit Checks on Suppliers and Customers

5 Reasons Why Small Business Owners Should Run Credit Checks on Suppliers and Customers